We are pleased to report that we had a very successful 2023 fiscal year.

In 2023, we spearheaded Lawyers Mutual’s community outreach and focused on CLE, risk management resources, and in-person speaking engagements.

The Enterprise and Operational Risk Management Team operates largely in the background. We understand privacy and information security is important to you and we work to keep our systems and your information protected

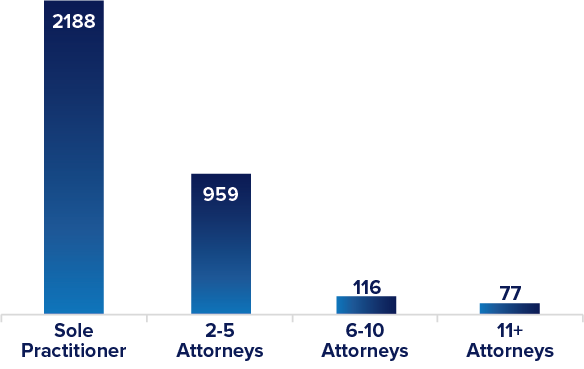

We continued to support the insurance needs of North Carolina attorneys in 2023 by writing 2,188 policies insuring sole practitioners and 959 policies insuring small law firms consisting of two to five attorneys.

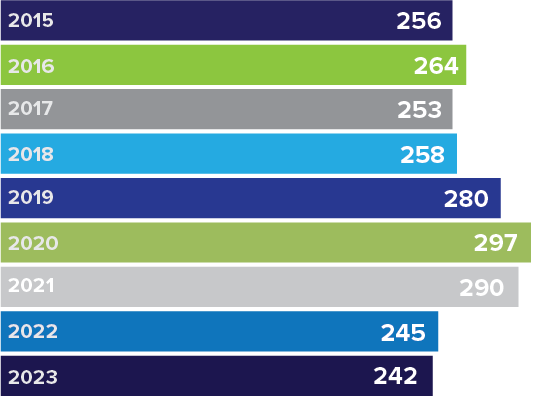

We are pleased to report that we had a successful 2023 fiscal year. Our open claim count remained low at 242.

For the fourth consecutive year, we experienced the highest volume of claims reported in Plaintiff’s Personal Injury practice area. Missed deadlines continued to be the primary driver of these errors, with the most common issues being missed statutes of limitations, lapsed alias and pluries summons, mistakes handling underinsured/uninsured motorist cases, and missed discovery deadlines. The other areas of practice with the most reported claims continue to be Residential Real Estate, Family law and Estates & Trusts.

In addition to spearheading Lawyers Mutual’s community outreach, especially with Community Boards and North Carolina legal associations, in 2023 we launched a CLE on demand platform, refocused efforts on in-person CLE, continued to write, evaluate and publish risk management resources, and returned to law offices for speaking engagements addressing practice management topics.

Following the successful launch of the CLE on demand platform, our numbers of on demand views and programs continue to climb.

We continue to work closely with our Claims team to update the Practice Guides available on the company website. These guides help our insureds stay current on evolving best practices and procedures, with the aim of further preventing the errors that have historically driven our highest-volume claims.

The Enterprise and Operational Risk Management Team operates largely in the background with tasks such as maintaining the technology and security programs, supporting other departments through business analytics, and developing and testing policies and procedures to maintain operations through unexpected events.

We understand privacy and information security is important to you and we work to keep our systems and your information protected. We also share tips and lessons learned that may be helpful in your technology journey through live and on-demand CLE’s and website content. Cyber criminals continue to increase their activity and target small and medium sized businesses. We must work together to avoid being an easy target – steps as simple as making a phone call to verify an email is legitimate before opening an attachment or link and utilizing mutli-factor authentication can go a long way in keeping all of us safe.

There is nothing more important than the partnerships we make with our insureds. Our underwriting accomplishments in 2023 were the result of those partnerships:

We continued to support the insurance needs of North Carolina attorneys in 2023 by writing 2,188 policies insuring sole practitioners and 959 policies insuring small law firms consisting of two to five attorneys.

In 2024, we will continue to support North Carolina attorneys by making conservative underwriting decisions that serve all our policyholders and promote the financial strength of the Company. We also plan to bring additional technology to our insureds, by adding the reissue application to our online portal.